A double-column cash book is a crucial tool for maintaining accurate financial records in business. It provides a structured way to record all cash transactions, categorized into two columns for receipts and payments. This organized system ensures clarity and helps businesses keep track of their cash flow efficiently. By implementing a double-column cash book, businesses can effectively monitor their income and expenditures, contributing to better financial management. Let’s delve deeper into how this simple yet powerful tool can streamline your accounting practices and boost your business’s financial health.

The Double Column Cash Book: A Comprehensive Guide for Beginners

Welcome to our guide on the double column cash book! If you’ve ever wondered how businesses keep track of their finances in a simple yet effective way, you’re in the right place. In this article, we’ll explore what a double column cash book is, why it’s important for businesses, and how to use it to maintain accurate financial records. Let’s dive in!

Understanding the Double Column Cash Book

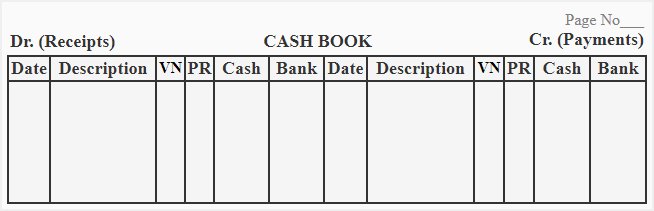

First things first, what exactly is a double column cash book? Simply put, it is a type of accounting record that helps businesses track their cash transactions in a systematic manner. The double column cash book is divided into two main columns: the debit column and the credit column.

In the debit column, all the cash received by the business is recorded, while in the credit column, all the cash payments made by the business are recorded. This double-entry system ensures that every transaction is recorded twice, once as a debit and once as a credit, helping maintain the balance and accuracy of financial records.

Importance of Double Column Cash Book

Now, you might be wondering why a business needs to maintain a double column cash book when there are other accounting methods available. The answer lies in the simplicity and efficiency of this system. By using a double column cash book, businesses can easily track their cash flow, monitor expenses, and identify any discrepancies in their financial transactions.

Moreover, the double column cash book provides a clear overview of the business’s financial performance, making it easier for business owners and managers to make informed decisions based on accurate data. It also helps in preparing financial statements and ensures compliance with accounting standards.

How to Use a Double Column Cash Book

Now that you understand the basics of a double column cash book, let’s delve into how to effectively use it for your business. Here are some key steps to follow:

Step 1: Setting Up the Cash Book

The first step is to set up the double column cash book by creating separate columns for the debit and credit transactions. You can use a physical ledger book or accounting software to maintain your cash book.

Step 2: Recording Cash Transactions

Whenever your business receives cash, such as sales revenue or loans, record the amount in the debit column of the cash book. Similarly, when your business makes cash payments, like expenses or salaries, record the amount in the credit column.

Step 3: Balancing the Cash Book

At the end of each accounting period, such as monthly or quarterly, it’s important to balance your cash book. This involves totaling the debit and credit columns separately and ensuring that they match. Any discrepancies need to be investigated and corrected.

Benefits of Using a Double Column Cash Book

There are several benefits to using a double column cash book for your business. Some of the key advantages include:

- Easy tracking of cash flow

- Identification of financial errors

- Centralized record-keeping

- Facilitation of financial analysis

- Enhanced decision-making

By maintaining a double column cash book, you can streamline your accounting processes, improve financial transparency, and ensure the long-term success of your business.

In conclusion, the double column cash book is a valuable tool for businesses of all sizes to maintain accurate financial records and track cash transactions effectively. By following the simple steps outlined in this guide, you can set up and use a double column cash book to enhance your business’s financial management practices.

Remember, consistency and attention to detail are key when using a double column cash book. With practice and dedication, you can master the art of financial record-keeping and propel your business towards greater success. Happy accounting!

THE DOUBLE COLUMN CASHBOOK

Frequently Asked Questions

What is a double column cash book?

A double column cash book is a type of financial ledger where all transactions related to cash receipts and payments are recorded in two separate columns – one for cash transactions and the other for bank transactions. This format allows for easy tracking and balancing of both cash and bank accounts simultaneously.

How does a double column cash book differ from a single column cash book?

A single column cash book records only cash transactions, while a double column cash book records both cash and bank transactions in separate columns. The double column format provides a clearer overview of both cash and bank balances at a glance, making it easier to reconcile accounts and monitor financial activities.

Why is it important to maintain a double column cash book?

Keeping a double column cash book is essential for businesses to accurately track their cash and bank transactions in a systematic manner. It helps in monitoring cash flow, detecting errors or discrepancies, and providing a clear picture of the financial position of the business at any given time.

How do you balance a double column cash book?

To balance a double column cash book, you need to ensure that the total of cash transactions column matches the total cash receipts and payments, and the total of bank transactions column matches the total bank deposits and withdrawals. Any discrepancies should be investigated and rectified to achieve a balanced cash book.

Final Thoughts

In conclusion, mastering the double column cash book is essential for accurate financial record-keeping. Its structured format simplifies tracking cash inflows and outflows, aiding in financial decision-making. By efficiently utilizing the double column cash book, businesses can maintain better control over their finances and ensure accurate reporting. Embrace this powerful tool to streamline your accounting practices and drive financial success.